Frequently Asked Questions

What are innovative financing models?

The phrase “innovative financing model” refers to mechanisms and instruments that were developed to provide suitable financing for large-scale and in-depth energy efficiency renovations in buildings. Examples of innovative financing models include instruments such as:

- Energy Performance Contracting (EPC)

- Third Party Financing (TPF)

- revolving funds

- cooperative models (REScoop)

- crowdfunding

- green bonds

Although these schemes have proven successful and have been applied in several contexts, they have not yet been widely used across Europe. There are still some barriers that block replication and extensive application of those schemes. This is why CITYnvest aims to overcome those obstacles.

A financial instrument is the financing technique that is being used to fund the projects. It can be:

- equity,

- loans,

- grants,

- bonds (public or private),

- utility incentives (green or white certificates),

- EPC or ESC financing,

- risk-sharing facility, etc.

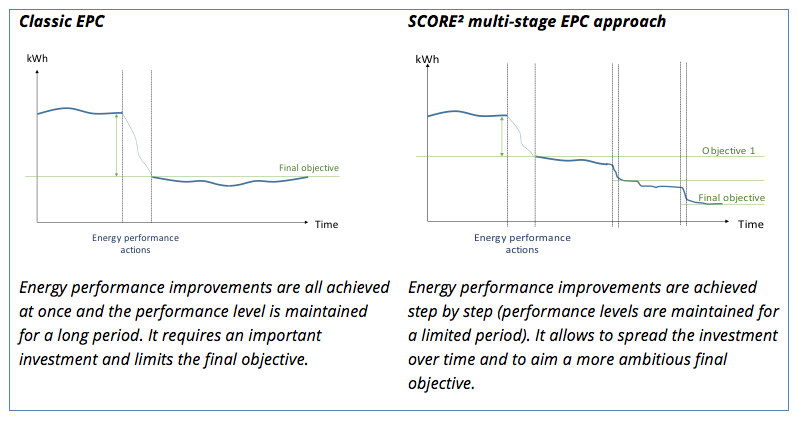

Energy Performance Contracting (EPC) is a form of creative financing for capital improvement which allows funding energy upgrades from cost reductions. Under an EPC arrangement, an external organisation (Energy Service Company - ESCO) implements a project to deliver energy efficiency, or a renewable energy project, and uses the stream of income from the cost savings or the renewable energy produced to repay the costs of the project (including the costs of the investment). Essentially, the ESCO will not receive its payment unless the project delivers energy savings as expected. The definition of EPC, and more information on it, can be found on the European Commission’s website.

ESCO stands for Energy Service Company. The term Energy Savings Company is also used. It is a company or an entity that delivers energy services or other energy efficiency improvements in an energy user’s premises, and accepts some degree of financial risk in doing so. The payment for the services delivered is based (either wholly or in part) on the achievement of energy efficiency improvements.

The Third-Party Financing refers solely to debt financing. The project financing comes from a third party, usually a financial institution or other investor, or the ESCO, which is not the user or customer.

A revolving loan fund is a source of money from which loans are made for multiple sustainable energy projects. Revolving funds can provide loans for projects that do not have access to other types of loans from financial institutions, or can provide loans at a below-market rate of interest (soft loans). The fund gets its name from the revolving aspect of loan repayment, where the central fund is refilled as individual projects pay back their loans, creating the opportunity to issue other loans to new projects. Revolving funds for sustainable energy provide financing to parties to implement energy efficiency, renewable energy, and other sustainability projects that generate cost savings. These savings are tracked and used to replenish the fund for the next round of investments, thus establishing a sustainable funding cycle while cutting operating costs and reducing environmental impact. The London Green Fund is a good example of a revolving loan fund. The definition can be found on the ManagEnergy website.

REScoops are examples of cooperative models. REScoop is short for Renewable Energy Sources Cooperative. REScoops are citizen-led initiatives that develop projects for renewable energy and/or energy efficiency, sell renewable energy or provide services to new initiatives. The term REScoops does not just refer to cooperatives in the legal sense, it also encompasses community energy initiatives under any other legal statute. There are about 2,500 REScoops in Europe. More information can be found on the Rescoop website.

Crowdfunding is an emerging alternative source of financing. It refers to open calls to the public, generally via the internet, to finance a project through either a donation, a monetary contribution in exchange for a reward, product pre-ordering, lending, or investment.

This definition can be found on the European Commission’s website.

Bond is a debt investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or fixed interest rate. Bonds are issued by companies, municipalities, states and sovereign governments to raise money and finance their projects and activities. Green bonds are all those instruments which are used exclusively to fund qualifying green investments.

Why should I invest in energy efficiency retrofits?

- Energy efficiency retrofits are a very effective way to cut emissions and contribute to European, national and local climate targets. And the potential for action is clear: energy consumption in buildings is responsible for 40% of the European Union’s primary energy demand and 36% of EU’s CO2 emissions.

- The investments boost local economies by stimulating local innovative industries, constructors, manufactures and energy service companies (ESCOs).

- Energy efficiency retrofits create sustainable jobs: according to the 2030 Climate and Energy package impact assessment, they will create up to two million jobs by 2020 and an additional 2 million by 2030. By their very nature, these jobs will be local.

- Energy efficiency investments have proven to be lucrative for building owners, as they ensure long-term financial benefits through reduced energy bills.

- By cutting down the energy bills of individual households, the investments can reduce energy poverty.

- The retrofits can improve health and life standards by upgrading thermal comfort and air quality. On average, we spend 90% of our lives in buildings, and thus improving indoor climate can bring important advantages in terms of higher productivity rates, learning abilities and better health conditions.

How to start a project?

A good starting point can be reading the report reviewing innovative financing and operational models for large-scale retrofits. It explains possible mechanisms and instruments that could be used by local authorities to realize renovation of their building stock. The document showcases the characteristics of the most effective initiatives that are currently being developed and deployed, as well as the challenges and risks inherent to each of the models. The report also includes a list of key questions that need to be addressed by the local authorities in order to build an action plan.

The report is complimented by a self-assessment tool; the Recommendations Decision Matrix. The Matrix contains a set of questions, which help to determinate which model will be the most suitable for the local authority.

The guide for the launch of a One Stop Shop on energy retrofitting explains how to start an energy retrofitting project and identifies the main challenges and success factors. The guide (in English) can be downloaded from the resources library.

For a complete overview of the financing opportunities for local authorities, visit the Reference Guide of the Covenant of Mayors initiative.

European financial support

| European Regional and Development Fund, Cohesion fund: find your country’s Operational Programme for 2014-2020 here. | EU28 Local authorities can be benificiaries (but also SMEs, associations and NGOs). ERDF is managed via your Managing Authority. Get in touch to find out how to get co-financing of your EE project, but also guarantees, loans, (quasi-) equity participation and technical assistance support. |

| Horizon 2020 (2016-2017 Research and Innovation Work Programme) | Under the 'secure, clean and efficient energy' chapter, different calls for proposals focus on buildings and financing topics. Calls relevant for sustainable energy can be found here. |

| Technical Assistance and Project Development Assistance (PDA) |

ELENA: managed by the European Investment Bank, that provides grants (90%) for technical assistance to launch large-scale sustainable energy investments (>€30 million). Leverage factor of 1:20 (€1 needs to mobilise €20). PDA under Horizon 2020 (call EE22) available for smaller project sizes (€6-50 million) and covers 100% of the eligible costs. Leverage factor of 1:15. |

| European Energy Efficiency Fund (EEEF) | The Fund operates as a dedicated bank to provide tailor-made debt and equity instruments for local and regional authorities. |

| European Fund for Strategic Investments (EFSI) | A guarantee of €16 billion should cover first losses of higher-risk projects and an additional €5 billion allocation of EIB capital to co-invest. this should trigger private investments of €315 billion. |

| The Renovation Loan | The renovation loan is an ESIF instrument that aims to combine public and private money for energy efficiency investments between €5-30 million. It provides access to finance at preferential conditions for loans up to 20 years maturity |

| Integrated Territorial Investment instrument (ITI) | The ITI is another vehicle to leverage ESI funding and provides an option for Member States to combine infrastructure investment in energy efficiency and training staff |

| Private Financing for Energy Efficiency Investment (PF4EE) | Under the EU's LIFE programmme together with the EIB, this pilot financial instrument will co-fund energy efficiency programmes. Currently this pilot programs started collaborations with local commercial banks. |

First of all: CITYnvest is created to support you, local and regional authorities, in developing your financing solutions for wide-scale renovation programs. Share your questions with us so we can support you finding the answer.

Secondly, following EU Advisory services are created to support you on financing related questions.

- Financial instruments advisory (Fi-Compass): This initiative provides guidance to create financial instruments, which make use of the Structural and Investment funds (incl. ERDF, CF, EAFRD and EMFF). One example of financial instruments in this context are the set up of a revolving Urban Development Fund (UDF), which can be blended from various financing sources and investing in public-private partnerships. More information can be found here.

- European Investment Advisory Hub (EIAH): The Hub was created as part of the ‘Investment plan for Europe’ initiative. It’s objective is to provide support in project development during the preparation phase (project structuring, financial advise, capacity-building). In order to make use of it, you need to fill in this contact form.

Even if multiple financing models have proven to be successful, many more political decision-makers and market players need to be convinced of the viability of the financing models for energy efficiency in order to accelerate the rate of multiplying the investment projects to their necessary levels (estimated €100 billion annually to reach the EU 2020 goals).

The CITYnvest pilot region GRE Liège started this process in 2014 and a first example of an ‘inspirational conference’ to convince the entire value chain can be watched here. Erika Honnay, project director of RenoWatt explains the importance of convincing stakeholders and ensuring political commitment: “Long term political commitment at the highest level of the public entity is crucial in launching a model for energy efficiency. In order to keep the long-term engagement from administrations, municipality technicians and all stakeholders, a strong commitment from the leaders of the municipalities is needed. This will assure uninterrupted decision process and progress.”

How to prepare the ground for the decision-making?

In order to facilitate the decision-making process at the municipal level in accordance with the timeframe, each decision has to be anticipated at least 3 months in advance. Meetings have to be organized with the relevant representatives in order to explain and discuss each point in detail. Those meetings might be linked to financial, technical or legal aspects. We have to make sure that the points are perfectly understood and that unchallenged information can go through the related departments, reaching all the stakeholders. The highest level of the public authority involved in the project has to be perfectly aware of the points discussed in order to defend it and lead to a formal decision.

A public facilitator should always prepare a fully detailed report at the attention of municipality’s authorities. They have to convince Town Council to fully adopt and endorse the project. Here are the main arguments to convince political decision makers:

Financial arguments

The key financial arguments to convince municipal authorities are the following:

- The project profitability and return on investment based on the Net Present value (NPV) methodology. All the figures and the ranges of investment for a specific public entity have to be clearly identified. It is essential to convert the costs and the revenues for the years to come in the Euros of a given year (1 EUR in 2030 does not have the same value as 1 EUR in 2017). The investment amount and energy savings are actualized based on the inflation, the expected increase of the energy costs, the interest rate of the loans, and the opportunity value of the capital. See Toolkit One Stop Shop annex 8 for an example.

- Energy savings argument: The reduction of energy bill is an easy-to-understand metric that can be used to communicate with citizens.

- Cash-flow: Most municipalities use loan or third-party financing that generate monthly reimbursement of capital and interest. The energy savings can take several years to cover this additional spending. The time needed for the project to register a positive cash flow is an important argument for municipalities: the quicker the cash flow of the project becomes positive, the better.

- The national or regional government can also provide incentives to renovate municipal buildings. For the pilot region Liège in Belgium, two regional levers will be used: subsidies covering nearly 20% of the investment and the ability for the municipalities to take on extra loans beyond budgetary boundaries.

Ecological arguments

- Being perceived by citizens as a pioneering ecological-friendly city is important for the image of the municipality. It demonstrates that the municipality ensures the well-being of its citizens and a good territorial development. Several benefits of refurbishment compared with demolition can be identified: reduction of landfill disposal, greater reuse of materials, reuse of infill sites and existing infrastructure and reduction of new buildings on flood plains. Municipalities can lead by example and show they do the required renovation to meet European targets:

- Member States of the European Union are committed to achieve the 20/20/20 goals: 20% reduction in CO2 emissions, 20% renewable energy and 20% energy savings between now and 2020. The response to climate change involves energy retrofitting of the building stock.

- Each Member State shall ensure that, as from 1 January 2014, 3 % of the total floor area of heated and/or cooled buildings owned and occupied by its central government is renovated each year to meet at least the minimum energy performance requirements retrofitting. Municipalities can show that they lead by example even without a specific EU requirement for renovation of public buildings owned by local governments.

Patrimonial arguments

Retrofitting buildings allows to maintain historical buildings and to combine ancient and modern architecture. It enhances the architectural heritage of the city. In energy retrofitting works, insulation (walls, roof and especially windows frames) is the most visible part of the process. Those works offer a patrimonial added value. Beside the asset gain, the visibility of the renovated buildings also promotes the actions taken by the authority towards its citizens.

Promoting local employment

Energy performance contracting models are offering an excellent opportunity to promote local employment. Energy retrofitting in Europe could generate the mobilisation/creation of more than 2,000,000 jobs in Europe. In the case of Energies POSIT’IF program, 1M€ invested in insulation works creates 26 additional full-time positions and 1M€ invested in renewable energy creates 6 additional full-time positions. In the case of Renowatt (GRE-Liège), 1M€ invested retrofitting work creates 17 local jobs. A special attention has to be paid to the social and ethical terms of the contracts, for example to limit subcontracting to 2 levels.

Political action

The renovation of buildings offers a good visibility of the actions taken by the elected representatives and an efficient use of public money. Municipalities can “Lead by example” and educate their staff in order to reduce the energy consumption of the buildings.

Take into consideration in your planning the decision-making process of municipalities

A deep knowledge of the constraints and the ways of working of the municipalities is crucial at every step of the project:

- Before launching the project: Large retrofitting projects should not be launched before an election period. An elected representative might launch the project and not be elected afterwards. There is no insurance that his successors will be committed in the retrofit program.

- During the preparation phase: in order to facilitate the decision-making process at the municipal level in accordance with the timeframe, each decision has to be anticipated at least 3 months in advance.

- During the validation phase: a validation calendar has to be perfectly respected at the municipal level in order to engage investments in such a project. This calendar has to be integrated in all the tendering processes (making sure to get enough spare time in order to face any unexpected circumstances - political life is not a long quiet river…).

Typical timing to validate a decision in Belgium is the following:

- Send memo to the municipal council (mayor and deputy mayors) – Week – 4

- Validation during the communal college meeting – Week – 2

- Validation during the town council – Week 0

- Reception of formal validation letter – Week +1

Communication, communication and communication, at all levels of the municipalities

It is also essential to be permanently in contact with the actors involved, as everybody needs to work in parallel in order to be as efficient as possible. It’s also crucial to identify the right interlocutors at each level (political, financial, legal, technical). In administrations, there might be a lack of communication between different services. It’s also part of our job to make sure that they all work on the project at their own level, having all the relevant information. In such projects, demanding a lot of actions and availability from the administration agents, the human factor is also very important to set a constructive, confident and motivating relationship with your interlocutors.

The identification of the building pools can provide a good solution for the management of property energy issues. The technique involves combining several buildings into a single joint project. It allows economies of scale by reducing the number of contracts and transaction costs. It also increases the negotiation power towards ESCOs to negotiate more interesting financial conditions. Furthermore, bundling building allows the diversification of the risk. Buildings with lower energy saving potential can also to be included with others having higher energy saving potential.

Small municipalities may not have enough buildings to reach a certain energy consumption baseline. It may then be possible to combine with one or several other municipalities which are interested in this project, and make the buildings “suitable” for Energy Performance Contracting (EPC).

There are two ways of pooling buildings:

- Either by mixing buildings of all kinds together (buildings with different sizes, a different levels of profitability, and with different functions),

- Or by gathering buildings of an equivalent function.

In the case of the One Stop Shop RenoWatt in pilot region Liège, the second option was chosen because it requires a limited diversity of competencies since all buildings have the same function. The innovative aspect of the way of pooling buildings consists for the One Stop Shop to gather buildings from distinct public authorities, and to combine large municipalities with small ones.

Identification of the building pools – The way of pooling the buildings is the innovative aspect of the One Stop Shop

The objective of the described actions below (from the energy cadastre to the quick scans) is to have an overview of the buildings to cluster them, depending on their consumption and the level of opportunity for an energy retrofit project. In some cases, a building’s level of dilapidation is such that its renovation would be too expensive. In that case, the building is not taken into account for the building pools.

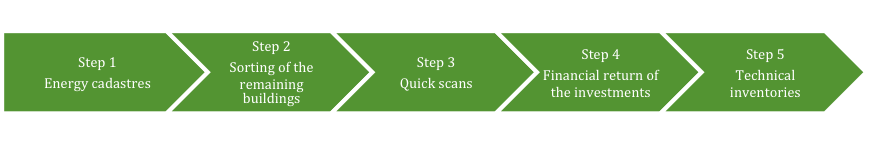

The pooling of buildings happens in 5 steps:

For the detailed building pools of RenoWatt, See Toolkit One Stop Shop annex 3.

The step-by-step process described below illustrates the importance of conducting the inventories gradually. It saves time and money; it avoids unnecessary work, and allows you to focus only on the buildings that will be taken into account.

STEP 1 – Energy cadastre

Establish an energy cadastre of the buildings. It helps to cut the number of buildings, by eliminating the unprofitable sites.

The role of the One Stop Shop is to interact with the energy officer within each public authority and work together to gather data (according to a methodology developed by the University of Mons. The methodology is explained in annex 10, p.53). Often public authorities do not have an updated list of the buildings they own. The cadastre details the specificities of the buildings (function, heated area,…). In order to gather the energy consumptions of the buildings, the One Stop Shop, with the public authorities’ agreement, directly contacts the energy distributor that will be able to give an overview of the building energy consumption, thanks to the EAN code (European Article Numbering).

An example of the sheet to complete can be found in annex 4 (p.45).

STEP 2 – Sorting of the remaining buildings

The second step aims at sorting the remaining buildings. For each building/site, a more detailed sheet needs to be completed. The content of the sheet is mainly technical. Data processing is an important task that is done off-site.

An example of the sheet can be found in annex 5 (p.47-48).

Before starting the third step of the selection process, the One Stop Shop presents the result of the first selection to each public authority. These meetings also help to reduce again the number of relevant buildings/sites.

Another best practice to share is that the documents to be completed should be first tested by one of the public authorities, and then validated. This helps to ensure that the energy managers will have the appropriate documents.

STEP 3 – Quick scans

The third stage of the selection process consists of performing quick scans to evaluate more in detail and more accurately the potential energy retrofits and which buildings should be renovated. Quick scans are done by local companies that are specialized in energy audits. A methodology is provided to the audit companies. It is important to note that one single company should have the lead on this task, even if it is subcontracting (parts of) the work. Unlike step 2, which was an office work, step 3 implies sites visits.

STEP 4 – Financial return of the investments

This step consists in making a financial estimate of the projects’ profitability (which energy gains will be done? In what time frame will the investments be absorbed?). The Net Present Value (NPV) method is being used to calculate the investments’ profitability. It can be summarized as follows:

- The NPV helps to define whether an investment in a project is profitable or not within a set time period

- To calculate to NPV, it is essential to convert the costs and the revenues for the years to come in the Euros of a given year (in the One Stop Shop’s case, the works start in 2017). 1 EUR in 2020 does not have the same value as 1 EUR in 2017

- The information needed to calculate the NPV of an energy investments project is the inflation, the expected increase of the energy costs, the interest rate of the loans, and the opportunity value of the capital.

- The NPV may include a residual value of the investment at the end of the contract.

An example of a sheet gathering the information to calculate the financial return of the investments and the NPV can be found in annex 9 (starting from p.52).

STEP 5 – Technical inventories

This step is about performing a detailed and technical inventory. It consists of making an inventory of the technical particularities of the buildings and of considering whether this is appropriate to renovate the buildings. It also aims at evaluating the costs related to replacing the existing elements (e.g. kind of boiler, age of the equipment, consumption, number of years to replace it). The inventory is based on the NEN2767 methodology[1], which enables to measure (using a score) the condition of a building in an objective way.

The result of the third and the fourth steps is to select some buildings and distribute them in pools. A financial “profitability” analysis will be done for each buildings pool.

In the case of the One Stop Shop RenoWatt, step 3 (quick scans), step 4 (financial return of the investments) and step 5 (technical inventory) were performed at the same time due to a lack of time. Ideally, quick scans should be done before the technical inventory since they allow to reduce the number of buildings and thus the number of technical inventories to do, which is expensive and time consuming.

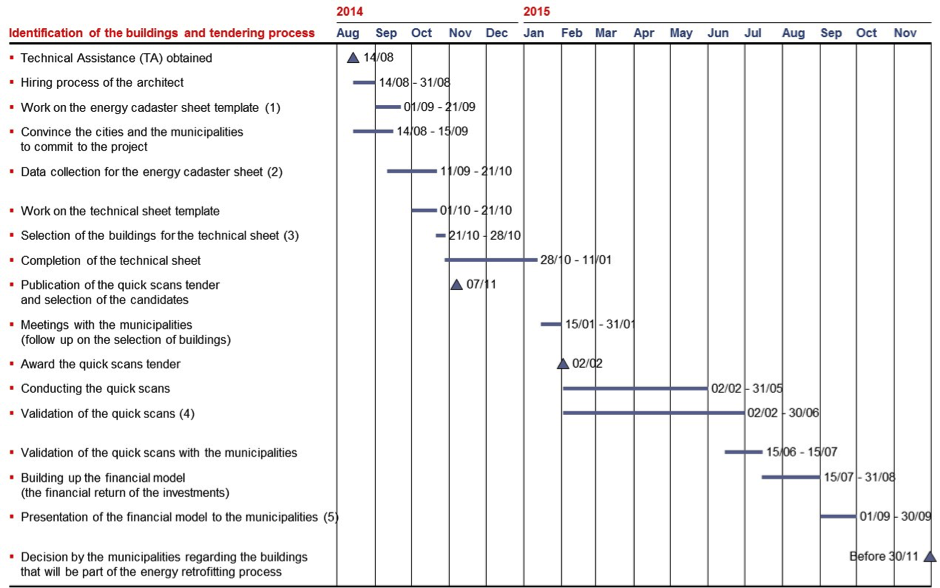

The 5 steps on a timeline

The chart below translates on a timeline the theoretical approach described above. It gives the planned timeframe regarding the identification of the buildings that will be pooled, the work on data collection, the follow up with the municipalities on the buildings to select and the validation of the buildings selected.

(1) Work on the energy cadastre sheet template: in the case of RenoWatt, it had to start from scratch for the content of the energy cadastre sheet. In the future, there will be no need to spend time on this task.

(2) Data collection for the energy cadastre sheet: this work has been done by the architect, who went “on the field”.

(3) Selection of the buildings for the technical sheet: this task consists in processing the data gathered for the energy cadastre sheet. It helps preparing the next step, which consists in selecting the buildings for which a technical sheet will be fulfilled.

(4) Validation of the quick scans: for time saving, the quick scans were conducted and validated at the same time.

(5) Presentation of the financial model to the municipalities: 2 meetings with each municipality were needed

***

[1] NEN2767 is a Dutch norm, which aims at the harmonization of the way of conceiving the maintenance of buildings. More info: http://iampro-e.crow.nl/instrumenten/nen-2767-condition-assessment

Tendering

The set-up of a “framework” (either a central purchasing agency or a procurement agency) at the very beginning of the One Stop Shop is a prerequisite for the launch of the tendering process. For further details on it, see section 6.5. Set-up of a central purchasing agency or a procurement agency (p.15-19).

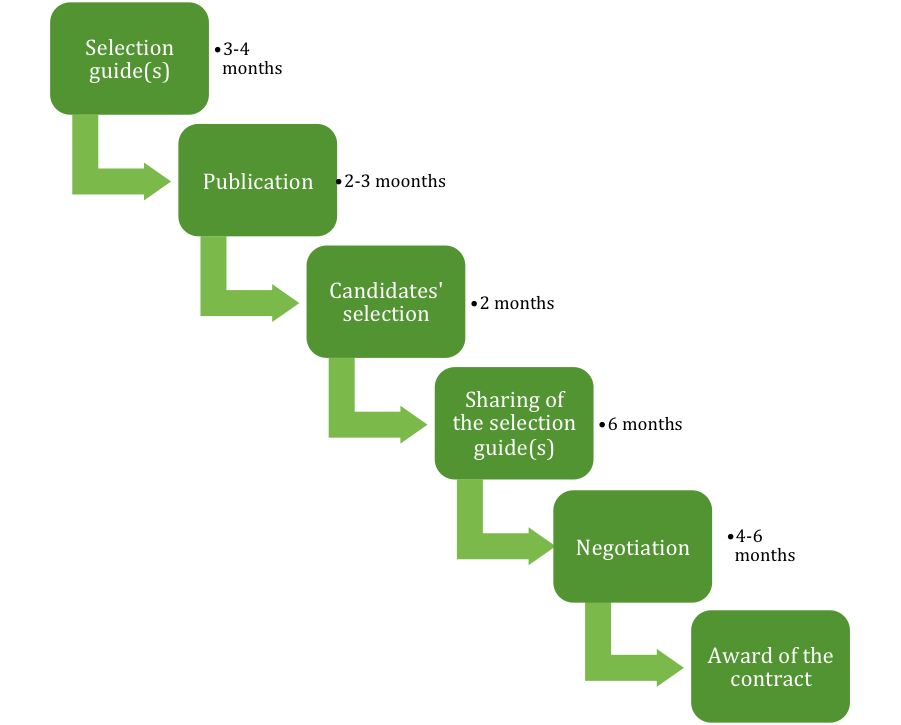

The chart below shows the different steps of the tendering process put in place by the One Stop Shop, from the draft of the selection guides to the award of the contract. Depending on the scope of the project, the tendering process may last between 17 to 21 months.

Explanation of the chart above

Selection guide(s): draft of the tender documents. It consists of preparing the specifications for each EPC-M (energy performance contracting and monitoring) pool.

Publication: Publication of the tender documents.

Candidate selection: selection based on qualitative and administrative criteria.

Sharing of the selection guide(s): the specification for each pool of buildings is sent to the shortlisted bidders.

Negotiation: the interested bidders make an offer in which they commit to decrease by xxx (to be determined) the energy consumption against a fee of xxx€ (to be determined). The bidders carry out themselves the energy audits of the buildings. The offers are compared.

Award of the contract: Notification and award of contracts (i.e. chose the bidders): a contract is signed by the chosen bidder and the contracting authorities. The One Stop Shop accompanies the contracting authorities during the whole process and advises them on the selection of the bidder, the contract negotiation and its implementation.

The chosen procedure by RenoWatt is the European negotiated procedure with publication, which has the advantage of being quite flexible, fast and not too expensive.

There is also what is called the « Competitive Dialogue » procedure (for further details on the procedure, please click here), which was not appropriate in RenoWatt’s case, since it is a longer and time-consuming procedure, and subsequently it costs money, either for the public tenderer, or the bidders.

For informational purposes, a detailed timeline on the tendering process for the school’s tender can be found in annex 11 (starting from p.54).

Elements to include in the public tenders

Environmental, social and ethical clauses, as well as an access to SMEs. The object of the contract is to reach energy efficient refurbishment with a view to socio-professional reintegration. Fostering local employment is the main mission of the piloting activities in the Liège Region (by GRE Liège).

A clause on giving the priority to new economic models and pushing to change the range of goods and services they offer

Qualitative selection:

- Focus on development in the region

- List of subcontractors once the applications have been received

- Administrative Certificates (adequate payment of all taxes)

Award criteria

- Score for the share of subcontracting with SMEs

- Scores for environmental and social aspects (maintenance plan, recycling, CO², emissions, etc.)

Conditions for implementation

- Limitation of extend of subcontracting

- Social implementation clauses

- Conditions for maintenance

- Reminders on minimum working conditions

Financial validation

See annex 11 of Toolkit: financial plan presentation.

Debt constraints

The states’ debt crisis and the budget constraints (the Walloon Government defines a yearly maximum amount of debt for municipalities, calculated according to the financial health of the municipality and the number of citizens) set up by the government are a barrier to launch ambitious retrofit projects.

Financing is key and a particularly complex aspect at different levels:

- Developing an appropriate financing model, which requires specific competencies, in accordance with the public debt constraint,

- Energy retrofit projects requires important early stage capitals,

- Financing and funding search.

Financing solutions will depend from one Member State to another. It is important to develop the solution together with the competent higher level of government. Eurostat has defined rules and so far, EPCs are very difficult to deconsolidate from the overall state debt.

Working with third party investments or funds (cf. different case studies studied by CITYnvest) is a financing solution. However:

- It is not a deconsolidating solution, whoever finances the project

- It is more expensive than a bank debt (especially for public authorities as it is considered as sovereign debt)

In the context of RenoWatt, it has been decided, together with the Walloon government, not to include energy retrofitting investments in the municipality budget constraint and to finance the retrofit works through simple debt (i.e. Bank loans).

Once the contract has been signed between the ESCO and the client, the details of the contract need to be validated, the works need to be done and followed up. The most important is to ensure that the ESCO fulfils its obligations. An EPC is based on a provided service and the commitment of a bidder to realize a minimum energy saving. Therefore, it is necessary to identify indicators and strictly monitor them, in order to make sure that the EPC is efficient. See Toolkit One Stop Shop annex 2 for more info on EPC’s.

For the Pilot Project in Liège, we will be using the IPMVP methodology, which provides a standardized plan for a Measurement and Verification. More information can be found on the Efficiency Evaluation Website.

The first step is to make the pilot project successful. Based on the learning, the methodology and tools should be refined and standardized to enable an efficient scale-up of the project.

The structure and team has also to gain in maturity in order to support the growth in the number of projects to handle. Having a dedicated operational team working in a so-called ‘programme-delivery-unit’ is key. Final clients don’t have neither expertise nor the time to launch pre-study to quantify potential savings and investments.

However the “individual” learning curve remains usually slow and is only one part of the story. In the absence of a dedicated reference framework, which can support all the actors of the value chain, most of the already well-identified barriers have to be first directly (re-) experienced by each newcomer (and to a certain extent by each sector) before being able to consider scaling-up. However, transaction costs will be lowered to a certain extent as a standardization process could appear (framework contracts being developed as well as the standardization of the monitoring part via measurement and verification protocols).

Often, a snowball effect is created when a first set of piloting activities fostered a track record of results that can convince other building owners (perhaps in other sectors) and investors to step in because of an increased trust. Many of the CITYnvest case studies are currently in the phase of scaling-up the pipeline of energy efficiency projects. Read about them here.

Aside from the financial capacity, one of the key bottleneck limiting the EPC take-off in Europe is indeed related to the possibility to apprehend in a clear, user adapted, transparent, coherent and constantly updated way all the information, assumptions and risks embedded in an EPC process. While ESCO companies have usually developed their own assessment and management tools, the client is usually not equipped to deal with this challenge. Given the complexity at stake, the client calls then a facilitator which is in most cases also constrained either to select its own tools and/or to develop them (usually using generic software such as Excel). However, it is possible that facilitators do not have access either to statistically meaningful reference databases limiting thereby the possibility of effective initial benchmarking.

The previous elements can translate into the following major obstacles to scaling-up:

- High costs and limited coherence of technical studies supporting reliable and multi-annual retrofit business models

- Time waste in the decision and implementation stages by limited tangible energy measures and scenarios assessment capacity

- Operational malfunction due to un-harmonized standardized practices and dialog trough the manifold stakeholders chain (especially between the tandem Owner-ESCO[1])

- Lack of consistent and updated data to adequately support the large-scale decision and implementation stages

- Poor risk assessment and mitigation capacity from the beginning till the monitoring, leading to a significant gap between expectations and actual performances

Those barriers emphasize the need for developing a consistent reference (IT supported) methodology for the growing uptake of EPC in in Europe, based on a harmonization and a higher integration level of the best practices consolidation and accessibility to the decision and expert chain.

Although some valuable tools are available on the market, this technical integration and harmonization (IT supported) framework does currently not exist and still needs to be developed. We need to pay a particular attention to make this framework both complete and flexible so that it can be used for all types of buildings (size, utility, type of ownership, etc.) and in all sectors. It should in particular support an efficient grouping (bundle) of buildings, a flexible approach to risk sharing, a capacity to support multiple EPC cycles for a specific building and a possibility of effective and up-to-date benchmarking. Each of those points is briefly described here below:

- As explained in the FAQ on 'how to efficiently bundle', the bundling of buildings offers a first possibility of major scaling-up. If properly capacitated, the owner can group several buildings into one contract or a facilitator can play that role and group several buildings belonging to different owners into a single contract providing a baseline efficiency potential. The use of a common framework to identify and categorize buildings would support a constant interaction between the buildings selection and pooling processes and would avoid unnecessary duplication of expensive preliminary technical studies.

- Thanks to the fundamental support of ISO 50001 EMS procedures, various risk transfer schemes can be implemented: from a full transfer of risk to the ESCO to a mix scheme where only partial elements of a given boundary are given to an ESCO under a limited liability EPC. The availability of reference methodologies and tools which allow stakeholders to internally develop their Energy Conservation Measures (ECM), either totally or partially, provides an essential flexibility which better takes into consideration the constraints and needs of buildings owners. The capacity to test various scenario at the outset of the EMS plan must thus be ensured to provide the flexibility which allows owners to envision their Deep Renovation Strategy without being obliged to consider from the initial stages the final contractual approach for any or all ECMs.

- Scaling-up is not only related to the question of extension of the geographical or sectorial coverage, it is also related to the capacity to reach the EU 60% energy performance improvement target. Due to the investments at stake and a number of other constraints, this objective can usually not be met in one renovation cycle but requests usually several cycles. Scaling-up requires a framework which aims thus also at supporting the several stages over a longer (typically 10/12 years) life cycle of the building renovation process.

- A key lesson learnt by projects implemented to date and funded by the European Commission is that the technical phases are absolutely crucial and that it is essential to have access to reliable databases allowing early benchmarking between buildings, reliable data on energy efficiency and operational costs and basic knowledge on energy efficiency. Actions are thus needed in order to identify/develop and maintain the reference databases necessary to use common valuers between projects Those are also a pre-condition to the possibility of benchmarking between buildings: the creation of a consolidated database based on diversified EU datasets that will be progressively enriched, checked, harmonized during and after the project’s experience would serve new end-users to quickly benchmark their own retrofit building pool dataset to this unique reference and could therefore also contribute to the scaling-up.

This existence and use of this technical and harmonization framework is a major driver for scaling-up. Pending its development, in an intermediary phase, it is nevertheless possible to use existing resources to address the above mentioned 4 key requirements. This requires also an important investment in training and support facilities, which are best apprehended by a “one stop shop” policy at regional/national levels together with the setting-up of a structural collaboration between European major knowledge centres.

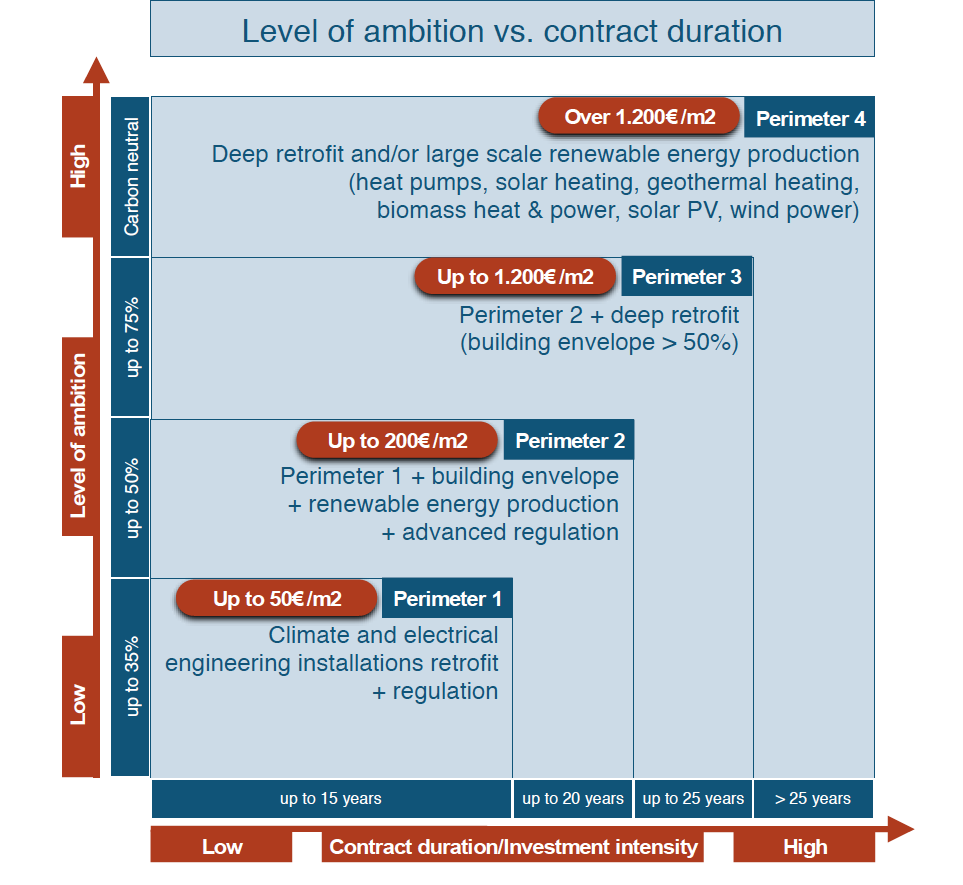

The level of ambition can be classified as follows:

Up to 35% reduction of energy consumption and/or GHG emissions

This level of ambition could be reached with short and middle term contract durations (average 10 years) based on technical installation (HVAC, lighting, electrical…) retrofits and managed energy services. As basic indicator, the price per square meter in case of a building retrofit could be less than 50€. Typically the ESCO market based offer targets this level of ambition. The market is also able to offer ESCO and TPF financing options for this level of ambition.

Up to 50% reduction of energy consumption and/or GHG emissions

This level of ambition could be reached with middle and long term contract durations (between 15 and 25 years) based on technical installations (HVAC, lighting, electrical…) retrofits, envelope retrofits (insulation), [near building] renewable energy generation and managed energy services. As basic indicator, the price per square meter in case of a building retrofit could be less than 200 €. There are various examples in Europe of EPC/ESC models that have addressed such a level of ambition. ESCO financing and/or TPF financing will be more challenging for this level of ambition.

Up to 75% reduction of energy consumption and/or GHG emissions

This level of ambition can only be reached with long or very long term contract durations (min. 25 years) based on deep retrofits. As basic indicator, the price per square meter in case of a building retrofit could range from 800 € to over 1500€. There are a few examples in Europe of EPC/ESC model that have addressed such a level of ambition. This level of ambition requires a mix of financing solutions (conventional financing, ESCO financing, PDU financing, Investment fund).

Carbon neutral

This level of ambition can only be reached with combined deep retrofit and renewable energy generation projects. There are very few examples in Europe of projects or models that have addressed carbon neutrality. This level of ambition will require a mix of financing solutions (conventional financing, ESCO financing, PDU financing, Investment fund).

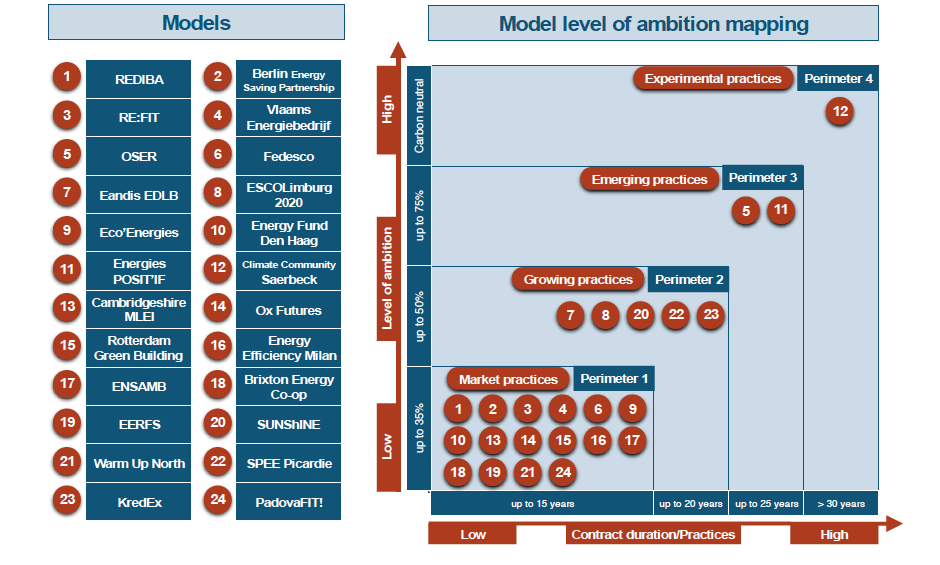

A great majority of the models target the first perimeter, as shown in the figure. This level of ambition could be qualified as the “standard market practice” that relies mainly on the facilitation operational model, the EPC/ESC implementation methodology (see below) and a conventional or Third Party Financing. However, we see that the factor 2 (50% savings) and factor 4 (75% savings) levels gain in attention, as 7 models are targeting those levels of ambition out of the 24 models analysed in the study. These models could be qualified as growing and emerging practices. They rely mainly on the Integration operational model and the Separate Contractor Based (SCB) implementation methodology. Furthermore, a majority of these models integrate the financing either through the Program Delivery Unit (PDU) or a dedicated investment fund. Carbon Neutrality is aimed at by one model only (Case Study Saerbeck), which is really different from the other ones as it combines all the approaches used in the studied models to achieve its objectives. The study has not identified another European initiative having a proven record in this field, meaning that this level of ambition remains the exception and could be qualified as experimental practice.

The implementation methodology is the method by which the projects are technically and operationally implemented in the field, most often by using contractors or subcontractors. Typical implementation models are Energy Performance Contracting, Energy Supply Contracting and Separate Contractor Based.

Separate Contracting Based (SCB) methodology

Separated Contracting Based is a method to implement multi-technique energy efficiency or renewable energy projects, by which each step of the process is dealt with by a separate party (energy auditor, engineering company, installer or contractor, maintenance company) and by which individual projects (e.g. boiler replacement, relighting, isolation, etc.) are executed by separate contractors for each technique.

This method is typically time consuming and requires a project coordinator to manage the process of getting all of the individual projects executed in a timely manner. For a public authority to use this method requires separate public tenders for each individual project. It requires also gaining a good knowledge of all the techniques involved in the field of energy efficiency and renewable energy, which is not easy. The method is therefore relatively resources and operational tools intensive and leads to more long completion times. In this method, the Program Delivery Unit (PDU) can act either as a facilitator or integrator (see below), but it can be useful to have the Program Delivery Unit (PDU) or another organization to act as an integrator to ensure an end-to-end delivery of the energy efficiency program and provide a consistent level of service from the different contractors.

A major disadvantage of this method is the fact that none of the subcontractors finally takes responsibility for the result of the global performance at the building or building stock level. This also means that the beneficiary or the Program Delivery Unit in case of integration takes on the technical and financial risks. Another disadvantage is the relatively high cost of transaction, meaning the cost of project design, procurement and management per euro invested. If they are not properly controlled, transaction costs can quickly represent a substantial share of achievable energy savings, reducing the potential scope of action of the model. In this method, there is also little room to access Third party financing (TPF).

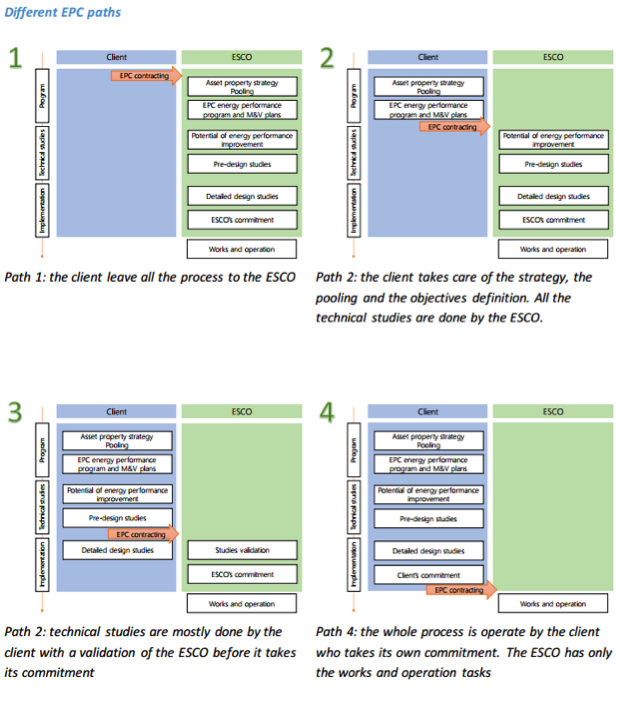

Energy Performance/Supply Contracting (EPC/ESC) methodology

In the Energy Performance Contracting (EPC)/Energy Supply Contracting (ESC) methodology, the Program Delivery Unit (PDU) relies on private ESCOs (Energy Services Company) or specialized contractors competing for the signing of an Energy Performance Contract (EPC) or Energy Supply Contract (ESC) for one or several buildings/projects (in case of bundling/pooling and/or aggregation).

This is one project, one contract that includes all buildings/projects, measures and technologies. The ESCO/Contractor performs the audits (as part of its offer), studies, design and works (at the start of the contract) and then operates and maintains the facilities.

In the EPC case, the ESCO/Contractor delivers a performance guarantee on the energy savings and takes responsibility for the end results (technical and financial). The EPC contract is the contractual agreement by which the output-driven results are agreed upon. Other aspects like maintenance can also be integrated and potentially be performance based. Performance guarantees are associated with a bonus and penalty scheme. Measurement and Verification (M&V) and Monitoring are key features of successful EPC contracts. EPC contracts can include financing schemes in which the ESCO/Contractor acts as financier or investor, but the beneficiaries can also finance these with own funds or through a financial institution.

In the ESC case, the ESCO/Contractor delivers « useful » energy (e.g. heat, cold, steam, electricity) to the customer at a contractually agreed price per kWh. The ESCO/Contractor is in charge of dimensioning, engineering, installing and maintaining the local production installation (e.g. boiler, combined heat & power, photovoltaic solar panels) for the duration of the contract. It typically manages the production efficiency of the installation to optimize the cost of transformation of the fuel into useful energy. The price for the useful energy delivered typically includes a fixed component to cover for the investment of the installation and a variable component to cover for the fuel usage.

In the EPC/ESC method, the Program Delivery Unit (PDU) can act either as a project facilitator or project integrator (see FAQ on Operational Services Framework). The tasks are mainly project management and coordination of larger contracts; the method is therefore less resources and operational tools intensive than the Separate Contracting Based one. The EPC/ESC method has the major advantage of outsourcing to ESCO/Contractors the technical risks and financial results of the projects thanks to the guaranteed energy savings or fixed price. This means that the beneficiary or the Program Delivery Unit in case of integration do not take on the performance risks of the projects. Another advantage of the method is the financial predictability of the projects thanks again to the guaranteed savings or fixed price. At the same time, experience shows that the transaction costs, meaning the costs of design and project management per euro invested could be lower than in the Separate Contracting Based method. Finally, the EPC/ESC methodology is also the key condition to access to ESCO and/or Third party financing (TPF).

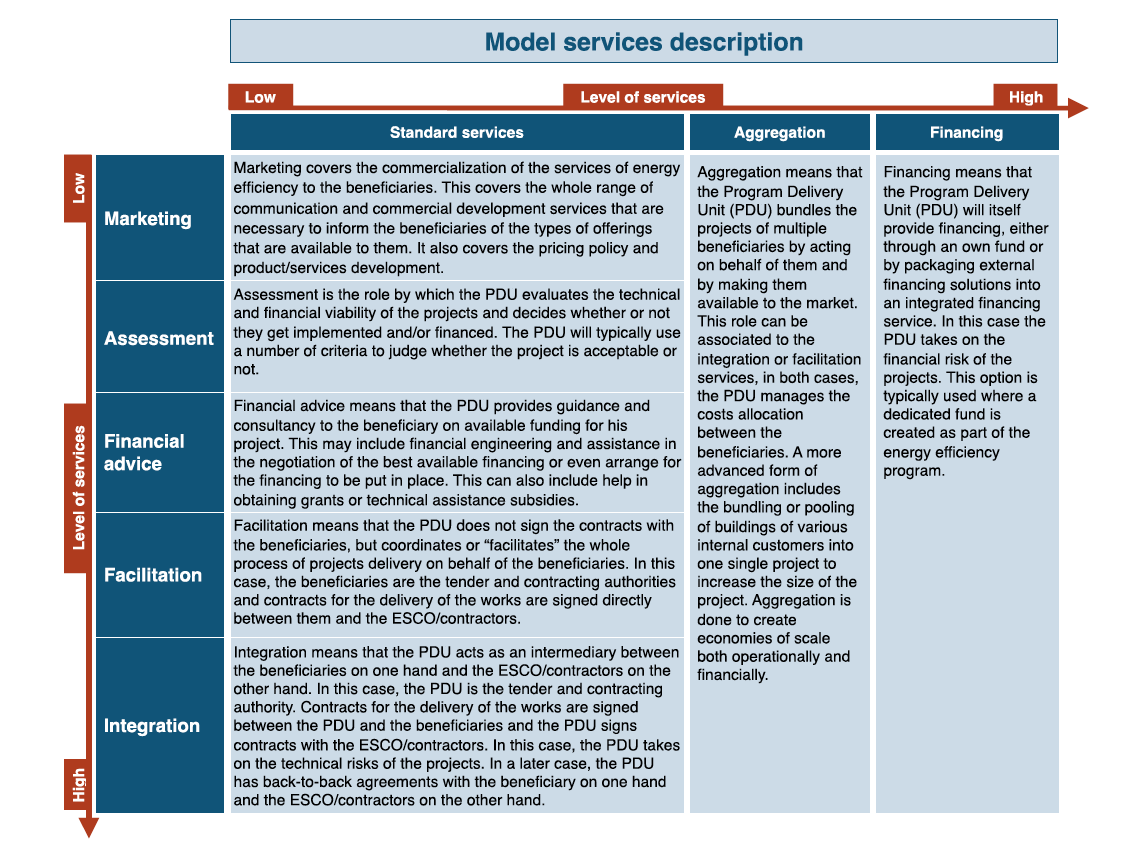

The operational services framework addresses the type of services that can be offered by the Program Delivery Unit (PDU) to the beneficiaries of the program. There are 7 levels of services delivered by the analysed models in CITYnvest:

- Marketing;

- Assessment;

- Financial advice;

- Facilitation;

- Integration;

- Aggregation;

- Financing.

The scheme below summarises the different services. Further details are provided below on the three main operational services facilitation, integration and aggregation.

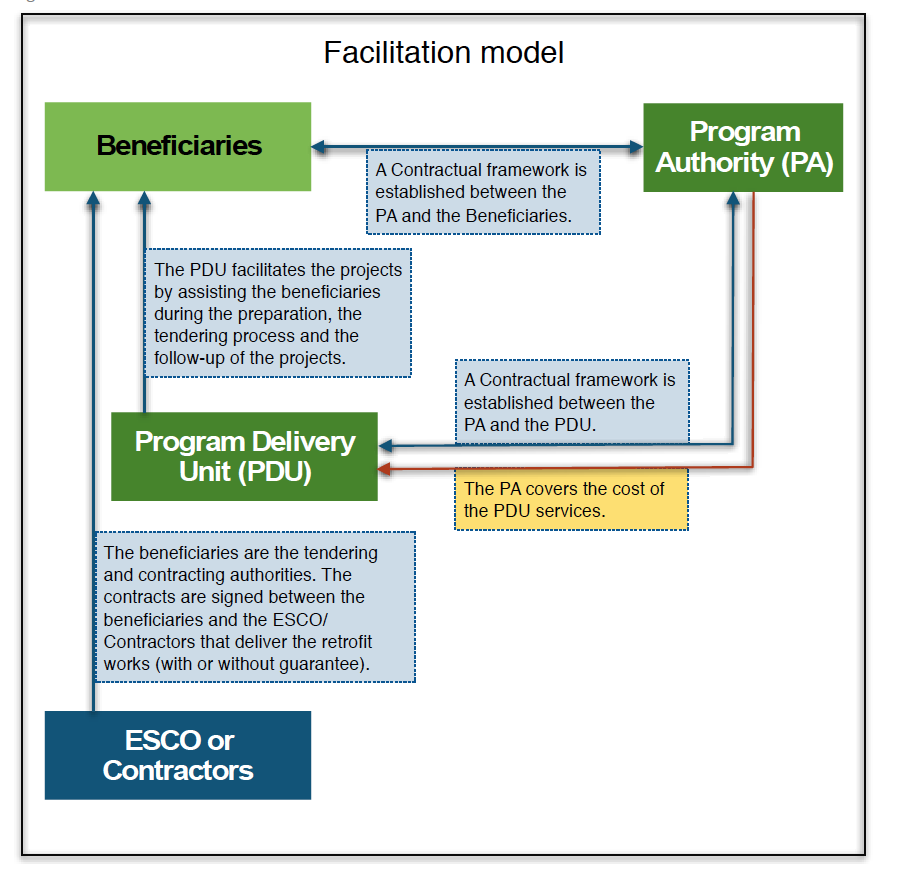

The Facilitation Model

Facilitation means that the Program Delivery Unit (PDU) acts as assistant to the project owner, but is not involved in the contractual level. The Program Delivery Unit (PDU) coordinates or “facilitates” the whole process of project delivery on behalf of the beneficiary while the contracts are signed directly between the beneficiary and the contractors. This model is often applied in case of the EPC/ESC implementation model, where the contract is signed directly between the beneficiary and the ESCO. Managing the tendering process is typically part of facilitation services offered in case of EPC or ESC projects.

In the Facilitation model, the Program Delivery Unit (PDU) does not take on the technical and performance risks of the project; those remain on the beneficiary’s shoulders or on the ESCO/Contractor (in case of the EPC/ESC implementation model). By definition, in the Facilitation model, the Program Delivery Unit (PDU) does not participate in the financing, but offers, in most cases, guidance to the beneficiaries to find the best financing solutions, either through ESCO’s (see ESCO Financing Model) or banks and/or third parties. In the most advanced cases, the financing is integrated via a dedicated operator (Investment fund and/or Citizens funding platform) upstream of the facilitation services.

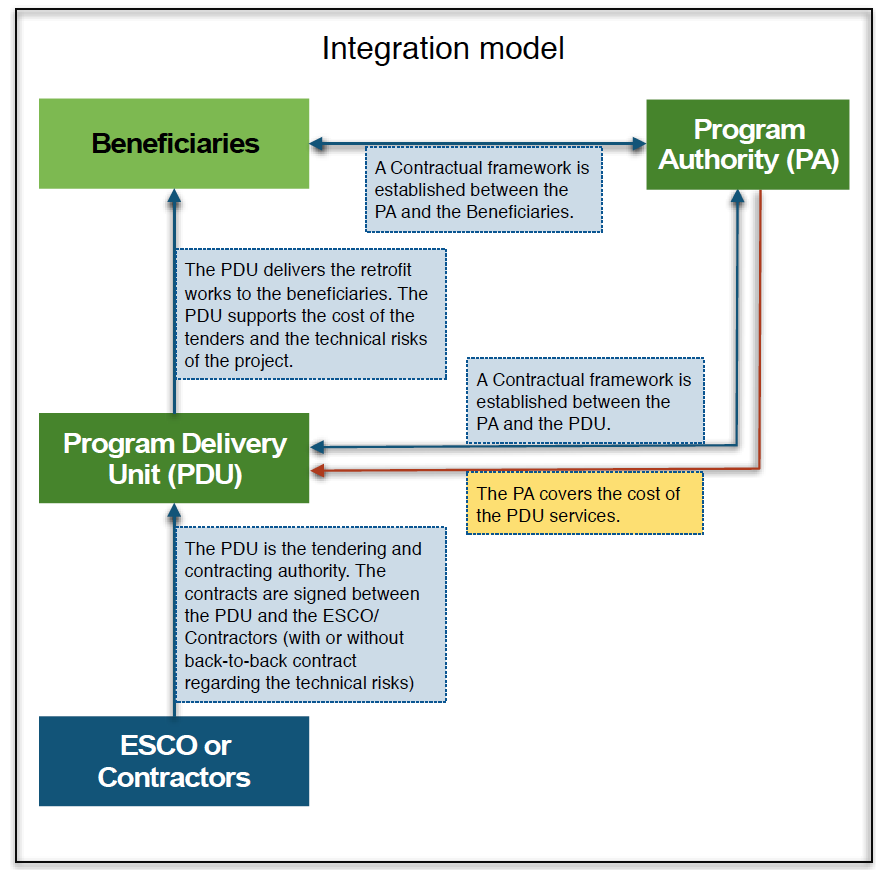

The Integration model

Integration means that the Program Delivery Unit (PDU) acts as an intermediary between the beneficiary on one hand and the contractors or subcontractors on the other hand. This means that the contract for the delivery of the energy efficiency is signed between the integrator and the beneficiary and that the integrator signs contracts with the (sub)contractors. In the Integration model, the Program Delivery Unit (PDU) takes on the technical and performance risks of the project, unless it has back-to-back agreements with the beneficiary on one hand and the ESCO on the other hand (in the case of the EPC/ESC model).

A priori, the Integration Model also includes financing (see PDU Financing and Investment fund models), unless the beneficiary finances the project with equity or debt. For this reason, it needs much greater capital and debt capacity to finance the projects. If funding is also part of the integration, it is either the ESCO/Contractors that provides it, or it is subject to a separate implementation, with or without competition with banks and/or third parties.

The integration model is often associated with the Separate Contractor Based implementation model, although it can also be applied to EPC or ESC. The two cases are described below:

The SCB Integration model: In the SCB integration model, the Program Delivery Unit (PDU) truly plays the role of integrator of a large number of stakeholders or subcontractors, for carrying out audits, studies, works or services, to offer a "packaged" solution to the beneficiaries. Its role is first to select these subcontractors, possibly putting them into competition; then make them execute their tasks. The job is essentially projects management and coordination, but nevertheless it requires a good knowledge of the different techniques used. Taking into account the complexity of energy efficiency projects, the adequate command of all techniques is not easy. This will require from the PDU strong quality control procedures and tools.

The EPC/ESC Integration model: In the ESC/EPC Integration model, the Program Delivery Unit (PDU) acts on behalf of the beneficiaries and manages the project process from the tendering to the implementation and follow-up of the project. In this case, this is one project, structured around a "back-to-back" contract between the Program Delivery Unit and the ESCO/Contractor.

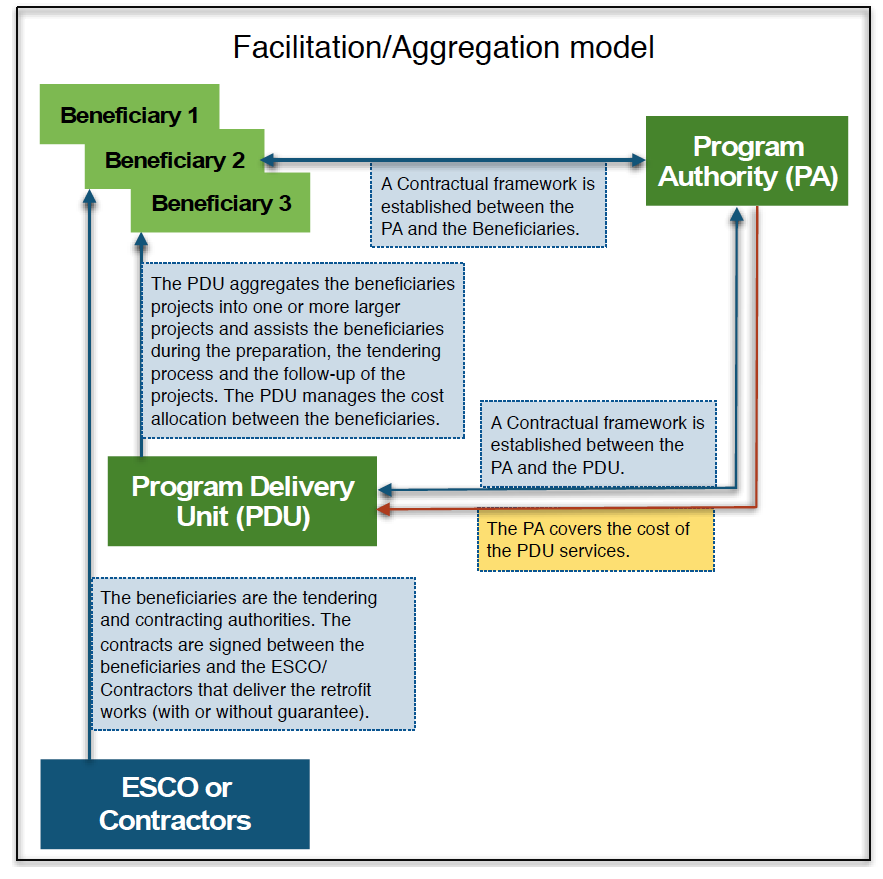

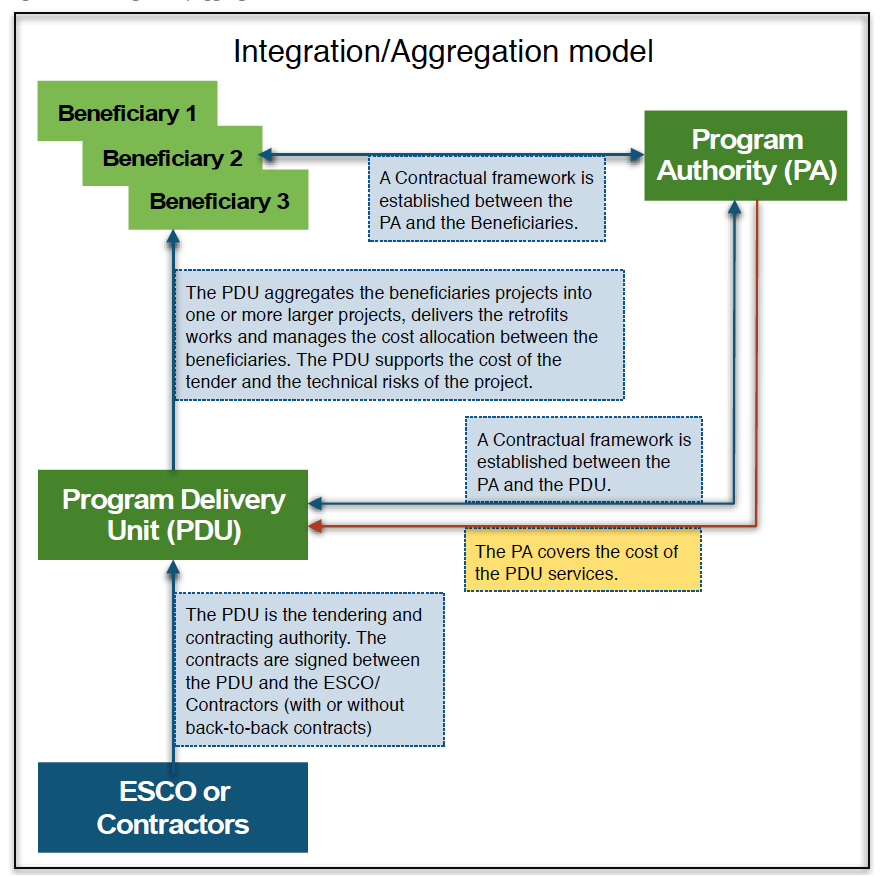

The Aggregation model

The aggregation model is a variation of the two previous models where the projects and/or the beneficiaries are bundled/pooled and/or aggregated in one or more larger project units:

Bundling/pooling:

Bundling/pooling means that the beneficiary or the Program Delivery Unit (PDU) bundles/pools the projects in one or more single projects to increase the size of the projects in order to make these feasible and/or to create economies of scale both operationally and financially. This approach could be applied either to the EPC/ESC methodology as well as to the Separate contracting methodology.

Aggregation:

Aggregation means that the Program Delivery Unit (PDU) bundles the projects or buildings of multiple beneficiaries into a single larger project. Aggregation is done to create economies of scale both operationally and financially. The aggregation service can include bundling/pooling of projects. This approach requires that the Program Delivery Unit (PDU) is entitled to act on behalf of the beneficiaries.

The two figures below describe the application of aggregation to both Facilitation and Integration models.

What are the operational services offered by the models?

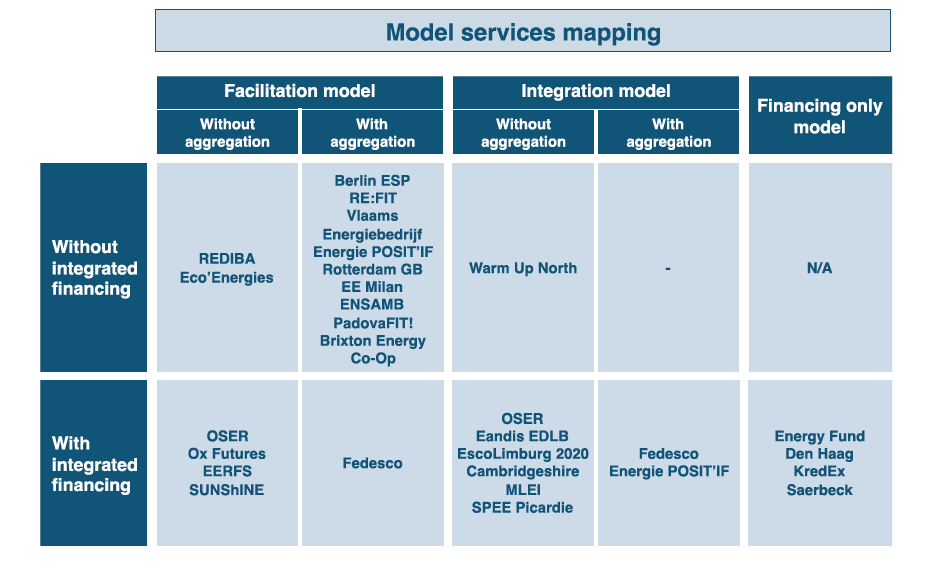

The figure below details the operational services offered by the 24 analysed models in CITYnvest.

Regarding the operational framework itself, 16 models are applying facilitation against 8 for integration, while 15 of them are applying aggregation. Regarding the financing framework, while 18 models offer financial advice, about 14 models integrate the financing in their service scope, with 3 models that are offering financing services only. It is mainly the models applying integration that integrate also the financing. Almost all models offer marketing and assessment services (23 out of 24). It is mainly French and Belgian public authorities that have developed integration models with integrated financing, while the facilitation model with conventional and/or Third Party Financing is more common in other countries. The reason probably is that both countries have a stronger culture of integration of public services.

What is the policy context?

The European Union has set a target for itself to increase its energy efficiency by 20% by the year 2020 and by 27% by 2030.

There are two EU directives when it comes to reducing the energy consumption in buildings: the Energy Performance of Buildings Directive (EPBD, 2010, and to be reviewed before the 1st of January 2017) and the Energy Efficiency Directive (EED, 2012).

EPBD includes regulations on the following points:

- Energy performance certificates for sale or rental of buildings

- Inspection for heating and air conditioning systems

- All new public buildings should be nearly zero energy buildings by 2018

- By 2020 all new buildings must be nearly zero energy buildings

- EU countries must set minimum energy performance requirements for new buildings, for the major renovation of buildings and for the replacement or retrofit of building elements (heating and cooling systems, roofs, walls, etc.)

- EU countries have to define all national financial measures to improve the energy efficiency of buildings

The EED includes:

- The framework for promoting energy efficiency improvements across the EU’s energy system: every year, EU countries are required to renovate at least 3% of the total floor area of buildings owned and occupied by central government.

- EU governments should only purchase buildings which are highly energy efficient.

- Member States must develop long-term national building renovation strategies which can be included in their National Energy Efficiency Action Plans (NEEAPs)

Since 9 July 2015, the total useful floor area requirement was decreased from 500 m2 to 250 m2 for both the energy performance certificates (EPBD, article 12) and the 3% rate of renovations in public buildings (EED, article 5).

Energy efficiency first principle is the acknowledgment that Europe's biggest domestic energy source is energy efficiency. It was first included in the European Commission’s Energy Union Strategy.

As an organising principle, “energy efficiency first”, applies to all policy-making and investment decisions and it includes:

- ensuring that energy saving solutions are not overlooked or undervalued;

- collecting reliable data which will allow to value the long-term economic, environmental and social costs and benefits of energy efficient solutions;

- removing barriers preventing energy efficiency improvements;

- developing and enforcing concrete policies, which will prioritize investment in energy efficiency.

Local authorities serve as example and stimulate innovative instruments for financing energy efficiency, especially in its public building stock and public lighting. A local authority can stimulate further market uptake and development for energy efficiency.

Local authorities benefit from energy efficiency improvements, and as the closest level to citizens, local authorities can encourage them to get involved in this process and support cooperative and citizen-based financing models and benefit from them.

In order to reach the European energy efficiency target, investments need to exceed 100 billion euro annually. Therefore the EU has several support schemes:

- Horizon 2020 - under the 'secure, clean and efficient energy' chapter, different calls focus on buildings and financing topics.

- Project Development Assistance (PDA): ELENA - managed by the European Investment Bank that provides grants (90%) for technical assistance to launch large-scale sustainable energy investments. PDA, under Horizon 2020 (call EE20) available for smaller project sizes (€6-50 million).

- European Energy Efficiency Fund (EEEF) - The Fund operates as a dedicated bank to provide tailor-made debt and equity instruments for local and regional authorities.

- European Structural and Investment Funds (ESIF) - Substantial amounts (€23 billion) are ring-fenced to support the low-carbon economy, depending on the Operational Programme in your area. Building renovation is eligible for funding in the ERDF, Cohesion Fund and ESF. These funding opportunities could also be drawn together through Multi-Fund Operational Programmes.

- The Renovation Loan is an ESIF instrument that aims to combine public and private money for energy efficiency investments between €5-30 million. It provides access to finance at preferential conditions for loans up to 20 years maturity.

- Integrated Territorial Investment instrument (ITI) is another vehicle to leverage ESI funding and provides an option for Member States to combine infrastructure investment in energy efficiency and training staff.

- Private Financing for Energy Efficiency instrument (PF4EE) - Under the EU's LIFE programme, this pilot financial instrument will co-fund energy efficiency programmes.

- European Investment Advisory Hub (EIAH) - As from September 2015, the EIAH will provide guidance on delivering quality projects and investments, reinforcing the use of financial instruments and improving access to financing.

- Enforcing existing European legislation

The EU has set a 20% energy efficiency target by 2020 for itself. However, current indicative national targets put forward by the Member States don’t add up to reach this target. Due to many exemptions, requirements for Member States annual savings are reduced to 0.8%.

The Energy Efficiency Directive and Energy Performance of Buildings Directive will be reviewed in 2016. The EU can use this momentum to authorize rigorously enforcement of the legislation and better monitoring of the progress.

A simple, harmonized and consistent system for monitoring and reporting climate and energy legislation, based on binding templates, would increase transparency and enforcement.

- Better technical assistance

Local authorities are leading by example and are developing new innovative financing models to increase renovation rates, mobilize necessary capital and create public-private partnerships. As the closest level of governance to the citizens, local authorities are able to get citizens engaged in energy efficiency. Yet, local authorities have limited access to finance because conditions to obtain technical assistance often exclude small- and medium-sized local authorities. More support in bundling projects between local authorities would allow them to reach critical investment sizes and set up bankable projects.

- Removing financial and legislative thresholds

The fiscal consolidation strategies affect the capacities of local and regional authorities in certain Member States to launch investments. The regulatory frameworks (European System of Accounts, neutrality and “debt consolidation rules”) could better support public energy efficiency investments, and ensure right risk assessments and long-term capital requirements for investments. Legislative frameworks could support further development of Energy Performance Contracting markets, citizen-based financing, green bonds and other instruments featured by CITYnvest.

Print HTML

Print HTML